Unemployment insurance tax calculator

A Williamsburg man was convicted of unemployment fraud and was ordered to serve a 100 day jail term for defrauding Iowas unemployment insurance program. Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020.

Income Tax Calculator 2021 2022 Estimate Return Refund

Unemployment insurance calculator Church tax.

. Website updated to improve use on mobile devices. Unemployed workers receive these benefits on the condition that theyre looking for a new job. It costs 12 of your income.

Your UI tax rate is applied to the taxable wages you pay to your employees. 2022 unemployment tax rate calculator xls 2022 unemployment tax rate table pdf 2020 unemployment tax rate FAQ pdf Learn more about how to appeal if you disagree with your unemployment tax rate. To combat and stop unemployment insurance UI fraud and identity theft we work actively alongside local state and federal law enforcement agencies government agencies claimants and employers in New York State and around the country.

Division of Unemployment Insurance provides services and benefits to. With the seasonal nature of much of the states workforce and Alaskas vast remoteness UI benefits serve not only to bridge the economic gap for the individual worker but also as a stabilizing influence on local. Benefits Estimator Labor Market Information for Montana including.

If you are out of work or have had your hours reduced you may be eligible to receive unemployment benefits. An employers guide to Unemployment Insurance tax reporting and Claims Processing. All 2022 Unemployment Insurance Tax Rate Determinations were sent out by US.

To remove a disqualification for voluntary leaving you must return to work in covered employment for at least eight weeks earn at least 10 times your weekly benefit rate and then become unemployed through no fault of your own. In contrast to other forms of social assistance individuals claims are partly dependent on their contributions which can be considered insurance premiums to create a common fund out of which the. To receive your Unemployment tax Employer ID and contribution rate immediately please visit httpsthesourcejfsohiogov The SOURCE to register your account.

You cannot be paid for weeks of unemployment after your benefit year ends even if you have a balance on your claim. This tax is required by state and federal law. Unemployment resources for employers including Wisconsin employer unemployment login.

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. You cannot withhold UI tax from the wages you pay to employees. Learn how to qualify for unemployment benefits.

Short-term capital gain or loss This is the total profit you realized from the sale of assets such as stocks bonds collectibles and other asserts owned less than one year. Who is an Agent. Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021.

Tax rate factors for 2022. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. Clifford Napier Assistant Director.

The UI Bureau of Tax and. We will calculate your weekly benefit rate at 60 of the average weekly wage you earned during the base year up to that maximumWe determine the average weekly wage based on wage information your employers report. For 2022 the maximum weekly benefit rate is 804.

Common notices sent to employers. Ohio Department of Job and Family Services Contribution Section. Take the Necessary Steps.

If you received a 1099-G and did NOT file a claim for unemployment benefits complete the Declaration of Identity Theft form attach a copy of the 1099-G and any other documentation showing that a fraudulent claim for unemployment. Unemployment insurance Arbeitslosenversicherung pays a percentage of your salary if you lose your job. All 2022 Unemployment Insurance Tax Rate Determinations will be sent out by US.

Paul Meade 55 had been convicted of fraudulent practice in third degree. How we determine your unemployment tax rate. Need to certify for benefits.

Unemployment Insurance Tax changes. We provide a detailed guide to eligibility conditions application methods various tools training programs organized for job-seekers and various other information. The Taxable wage base for 2022 is 38000.

The insurance may be provided publicly or through the subsidizing of private insurance. Alaskas Unemployment Insurance UI program is dedicated to providing unemployed workers fast and accurate payment of UI benefits. The Unemployment Benefits calculator is intended to be a quick reference for determining your approximate potential benefit amounts.

The Unemployment Insurance Divisions mission is to provide economic stability to Wisconsin communities employers and employees through innovative efficient services which facilitate connecting job seekers with jobs. To register your account by paper please complete a Report to Determine Liability JFS-20100 and mail it to. Meade said that he filed for unemployment insurance benefits between December 27 2015 and June 25 2016.

If you are a member of certain churches you pay a church tax. Depending on the contract other events such as terminal illness or critical illness can. The calculator will use the amount entered to calculate your spouses Schedule SE self-employment tax.

Social insurance is a form of social welfare that provides insurance against economic risks. If you claim unemployment from a program thats unrelated to a pandemic-related unemployment program like Georgia Unemployment Insurance UI youll need to take additional steps to qualify. 1099-G forms are automatically generated for all individuals where an unemployment compensation payment was made.

Agent User Guide. Overview of tax rates Overview of 2022 UI Tax Rates. Its a percentage of your income tax.

Your 1099-G reflects the total amount paid to you in 2020 regardless of the week that payment represents. The Department of Labor works very hard to protect the integrity of our agency and programs. Then follow these steps to register and apply for unemployment certify your benefits and manage your claim.

The results obtained are not guaranteed to be accurate. How they affect you. All SSNs can certify from 8am to 6pm Certifications are processed nightly so certifying first thing.

Mail to Minnesota employers on or before December 15 2021. Wage Theft Legislation 2019. Calculate your unemployment taxes.

New agent account information. Unemployment Rates Industry Wage Occupation Career Resources and other Publications. The examiner will decide if you can receive benefits based on Unemployment Insurance laws and regulations.

What Is SUI State Unemployment Insurance. State unemployment insurance SUI is a tax-funded program by employers to give short-term benefits to workers who have lost their job. Continue to certify for benefits.

Mail to Minnesota employers by December 15 2021. A regular unemployment insurance benefit year ends 12 months after the claim started. Assigned daily range of Social Security numbers SSNs can certify from 8am to 8pm Sunday or 9pm Monday through Thursday Friday.

The 4 quarters in your base period are the 1st 4 of the last 5 complete calendar quarters.

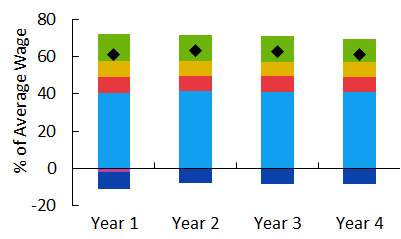

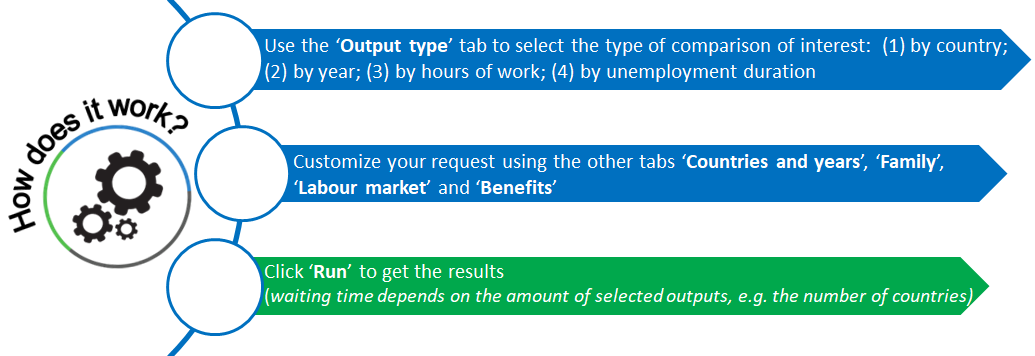

Tax Benefit Web Calculator Oecd

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Tax What It Is How To Calculate It Bench Accounting

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Benefit Web Calculator Oecd

Payroll Deductions Calculator For Estonian Companies Enty

China Individual Income Tax Calculator 2021 Echinacareers

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How Much Tax Will I Have To Pay On Cerb Consumer Credit Counselling

Ontario Income Tax Calculator Wowa Ca

Forecasting State Unemployment Home Cruis

Should You Buy Down Your 2021 Unemployment Insurance Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Ca Income Tax Calculator August 2022 Incomeaftertax Com